Duck Creek Industry Content

Accelerate product development across personal, commercial, and specialty lines of business

About Duck Creek Industry Content

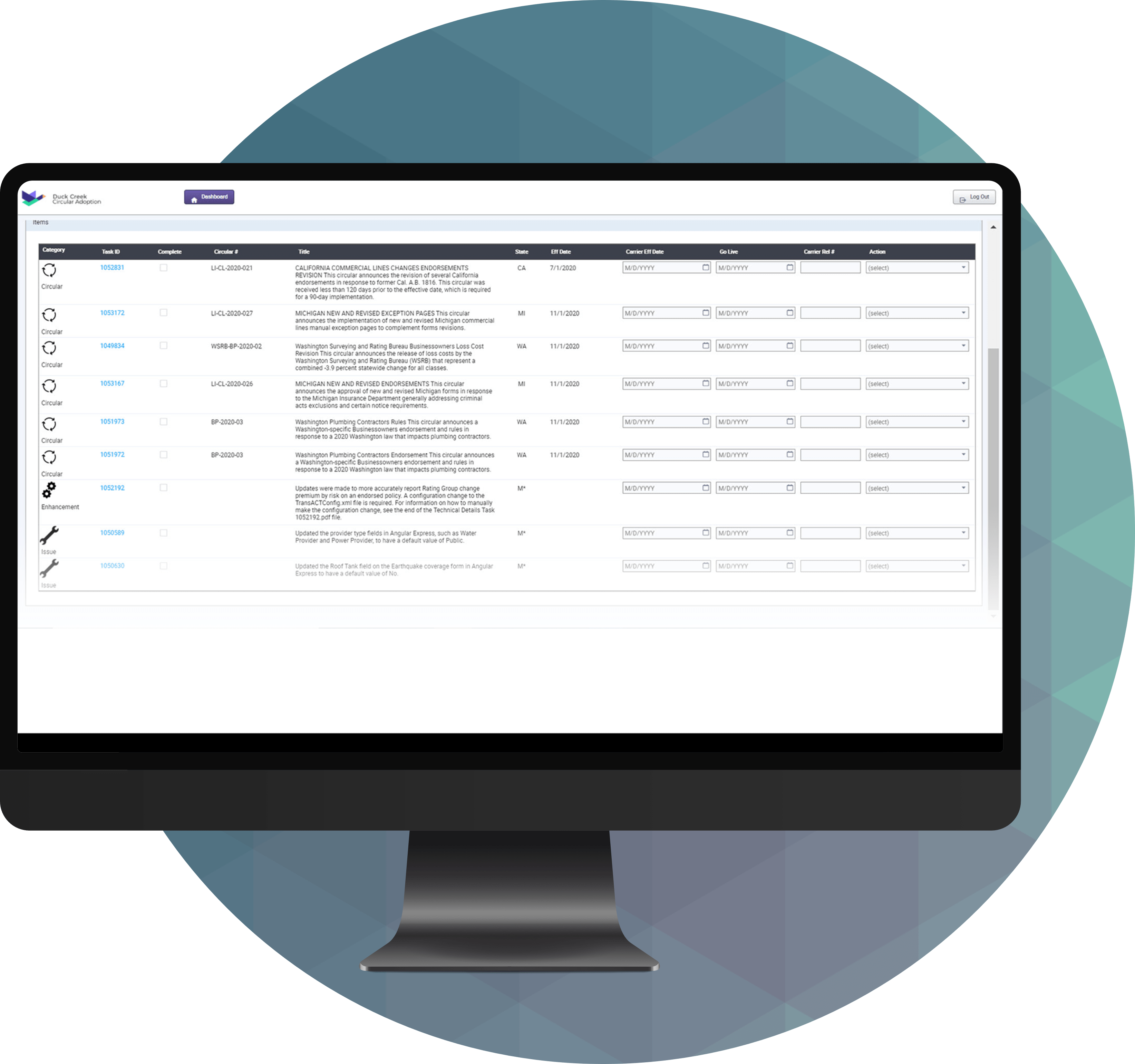

Duck Creek Industry Content consists of pre-built commercial lines bureau content from ISO, AAIS, AIB, NCCI, and independent workers’ compensation bureaus, Line of Business Kits, as well as implementation accelerators and integrations with third-party solution providers that enable carriers to rapidly launch new products and meet evolving customer needs.

Learn more about accelerating speed to market with pre-built industry content in our practical guide.

Benefits

Reduce Time to Market

Whether you are launching a minimum viable product or iterating on an existing offering, Industry Content gives you a jumping-off point for creating compelling insurance products and ensures that you can swiftly capture market opportunities.

Stay Current and Improve Pricing Decisions

By processing an average of 1000+ bureau circulars annually and maintaining carrier’s prior deviations, we enable insurers to focus on what truly matters – differentiation. Inject your own secret sauce into bureau products, leverage the latest actuarial data to minimize adverse risk selection, and refocus resources to support non-bureau-related product development.

Drive Product Innovation

Being competitive means more than just producing the lowest quote. Rating accuracy and underwriting efficiency is driven by services and automated processes enhancing data capture and augmenting underwriting decisions. Incorporate integrations to the insurance vendor ecosystem into the overall product design to gain a competitive advantage.

A Proven Solution for all Lines of Business

1000+

Bureau circulars processed annually

9000+

Forms available as part of support

98%

Bureau circular updates available on the first business day of every month

45

Days to go-live with commercial lines templates

250+

Number of content kits spanning integrations to third party services and solutions, line of business kits, and other utilities

Partnerships

Our Content Exchange features Industry Content for all lines of business across P&C Insurance.

Testimonials

OnDemand enables us to keep up with the pace of technology changes and enhances our ability to launch new products. It helps us focus on the core needs of our business rather than get bogged down with operational tasks like platform/infrastructure upgrades and template updates.

Murali Natarajan

SVP & CIO

Useful Resources

Press Release

Duck Creek Technologies Strengthens Global Sales Leadership with Strategic Appointments in…

New executive hires reinforce the company’s commitment to elevating the customer experie…

Read More

Blog Post

Duck Creek Named a Leader in the Gartner…

Insurance companies are modernizing systems and adopting advanced technologies to overcome…

Read More

Blog Post

Unifying Underwriting and Loss Control to Increase Profitability

In today’s competitive insurance landscape, underwriting profitability hinges on mak…

Read More

Policy

Customer needs are evolving rapidly. Duck Creek Policy is a powerful and flexible policy administration system that enables carriers to service the complete policy lifecycle.

Rating

Duck Creek Rating is a robust and flexible rating engine that provides carriers with the tools they need to develop new pricing schemes and maintain products for all lines of business.

Frequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an à la carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.

See It In Action Today

Whether you’re launching a greenfield initiative, changing providers, or looking to make a digital transformation, our multi-faceted team of insurance and technology experts can help get you there.